Risikowarnung: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 35.45% of retail investor accounts lose money when trading CFDs. You should consider whether you under

Handeln Sie CFDs auf Rohstoffe

Handeln Sie mit Gold, Silber, Platin, Palladium, Rohöl und Erdgas

35.45% of retail CFD accounts lose money

Handeln Sie mit globalen Rohstoffen

Symbol

Gebot

Fragen

Verbreitung

*Die Preise auf dieser Seite sind Richtwerte. Die Preise für Instrumente mit geringerer Liquidität, wie beispielsweise exotische Währungspaare, Aktien und Indizes, werden nicht so häufig aktualisiert wie die Preise für häufig gehandelte Instrumente. Die aktuellen Live-Preise finden Sie in Ihrer MT4-Plattform.

Was sind Rohstoffe?

Rohstoffe wie Gold, Silber, Platin, Öl und Erdgas sind Rohmaterialien, die eine grundlegende Rolle in der Weltwirtschaft spielen. Ihre Preise stehen in direktem Zusammenhang mit ihrer Entdeckung, Gewinnung und ihrem Verbrauch und bestimmen die Kosten vieler Waren und Dienstleistungen. Sie können mit ihnen handeln, um von dieser Dynamik von Angebot und Nachfrage zu profitieren.

Beliebte Rohstoffe

Rohöl

Symbol: USOIL

Brent-Öl

Symbol: UKOIL

Erdgas

Symbol: USNGAS

Gold

Symbol: XAUUSD

Silber

Symbol: XAGUSD

So funktioniert der Rohstoffhandel

Der Rohstoffhandel ermöglicht es Ihnen, auf die Preisbewegungen von Rohstoffen zu spekulieren, ohne die physischen Rohstoffe zu besitzen. Wenn Sie davon ausgehen, dass der Preis einer Ware steigen wird, können Sie diese einfach kaufen. Wenn Sie davon ausgehen, dass der Preis der Ware fallen wird, können Sie diese verkaufen.

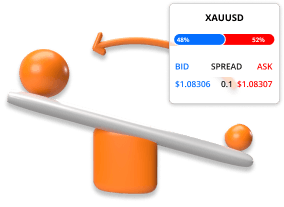

Geld- und Briefkurse

Jeder Rohstoff wird mit zwei Preisen notiert, dem Geldkurs und dem Briefkurs. Der Geldkurs ist der Preis, zu dem Sie den Rohstoff verkaufen können. Der Briefkurs ist der Preis, zu dem Sie die Ware kaufen können. Der Geldkurs ist immer höher als der Briefkurs, und die Differenz zwischen diesen Preisen wird als „Spread” bezeichnet.

Long- oder Short-Positionen möglich

Die Grundidee besteht darin, zu kaufen (Long-Position), wenn Sie glauben, dass die Ware an Wert gewinnen wird, und zu verkaufen (Short-Position), wenn Sie glauben, dass sie an Wert verlieren wird. Sie können Rohstoffe long oder short handeln, d. h. Sie können sowohl bei steigenden als auch bei fallenden Preisen handeln.

Rohstoffe werden in Lot gehandelt

Beim Handel mit Rohstoffen werden Trades in Lot platziert. Ein Lot wird durch die Menge der gehandelten Rohstoffe bestimmt. Ein Standard-Lot für Gold entspricht beispielsweise 100 Unzen, ein Mini-Lot 10 Unzen und ein Mikro-Lot einer Unze. Weitere Informationen Kontraktspezifikationen zu den Lot-Größen von Rohstoffen finden Sie auf unserer Seite.

Der Rohstoffhandel beinhaltet Hebelwirkung und Margin

Der Rohstoffhandel beinhaltet den Einsatz von Hebeleffekten, die es Ihnen ermöglichen, Rohstoffe zu kaufen und zu verkaufen, deren Wert über dem Betrag Ihres Handelskontos liegt. Wenn Sie beispielsweise mit einem Hebel von 10:1 handeln, können Sie 100 Barrel Rohöl zu nur 10 % des aktuellen Marktwertes kaufen. Hebeleffekte können potenzielle Gewinne vergrößern, erhöhen jedoch auch das Risiko und beschleunigen Verluste.

Beispiel für den Rohstoffhandel

Sie entscheiden sich, 0,1 Lot Rohöl zu 70 $ mit einem Hebel von 10:1.

0,1 Lot = 100 Barrel Rohöl

100 barrels x $70 = $7,000

USD 7,000 / 10 = $700

Szenario 1

Der Preis für Rohöl steigt von 70 $ auf 80 $ und Sie entscheiden sich zum Verkauf.

So würde der Gewinn oder Verlust aus dem Handel berechnet werden.

P/L = (Aktueller Preis - Anfangspreis) x Menge

P/L = ($80 - $70) × 100

P/L = $10 × 100

P/L = $1,000

Szenario 2

Der Preis für Rohöl sinkt von 70 $ auf 60 $ und Sie entscheiden sich zum Verkauf.

So würde der Gewinn oder Verlust aus dem Handel berechnet werden.

P/L = (Aktueller Preis - Anfangspreis) x Menge

P/L = ($60 - $70) × 100

P/L = -$10 × 100

P/L= - $1,000

Handel mit hohem Wert und einem Premium-Service

Deswegen wählen Personen wie Sie TIOmarkets

Spreads ab 0,0 Pips

Handeln Sie mit variablen Spreads direkt von unseren Liquiditätsanbietern.

Null Kommission

Handeln Sie mit variablen Spreads direkt von unseren Liquiditätsanbietern

Geringe Mindesteinlage

Eröffne dein Konto bereits ab 100 €, um mit dem Trading zu beginnen

24/7 Kundendienst

Wir sind hier, mit 3 Sekunden durchschnittlicher Reaktionszeit im Live-Chat

Schnelle Orderausführung

Trades werden in Millisekunden mit geringer Slippage ausgeführt, meist

Zuverlässige Plattformen

Handeln Sie ab 0 $ pro Lot auf unserem VIP Black- oder Standard-Konto

35.45% of retail CFD accounts lose money

Handel auf der MT4-Handelsplattform

MT4 wurde für den Forex- und Futures-Handel konzipiert und entwickelt. Es ermöglicht Händlern, Finanzmärkte zu analysieren und zu handeln, Handelsstrategien zu testen, Handelsroboter zu entwickeln und andere Trader zu kopieren.

Verfügbar für:

Der Einstieg ist schnell und einfach

Es dauert nur wenige Minuten, so funktioniert es:

SCHRITT 1

Registrieren

Füllen Sie ein einfaches Formular aus, um Ihr Profil zu erstellen und den Verifizierungsprozess abzuschließen. Sobald Sie verifiziert und genehmigt wurden, können Sie Ihr Handelskonto erstellen.

SCHRITT 2

Fonds

Zahlen Sie sofort mit Ihrer Debit- oder Kreditkarte ein. Laden Sie die Handelsplattform auf Ihren Computer oder Ihr Smartphone herunter.

SCHRITT 3

Handel

Wählen Sie ein Instrument und eine Richtung, entscheiden Sie, wie viel Sie investieren möchten, und platzieren Sie Ihren Handel.

35.45% of retail CFD accounts lose money

Erfahren Sie mehr über unsere Handelsbedingungen

TIO Markets CY Limited, a company authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC), has decided to voluntarily renounce its authorisation and has submitted the relevant request to CySEC.

As a result, the company is not accepting new clients.

Existing clients with remaining balances are requested to log in to their accounts and withdraw their funds.

In case of any questions, please contact [email protected]

In case of any complaints, please contact [email protected]