Risicowaarschuwing: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 35.45% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and

Trade CFDs on commodities

Trade gold, silver, platinum, palladium, crude oil and natural gas

35.45% of retail CFD accounts lose money

Trade global commodities

Symbool

Bid

Ask

Verspreiden

*The prices on this page are indicative. Prices for instruments with lower liquidity such as but not limited to exotic currency pairs, stocks and indices are not refreshed as often as commonly traded instruments. Please check inside your MT4 platform for latest live prices

What are Commodities?

Commodities like gold, silver, platinum, oil and natural gas are raw materials that play a fundamental role in the global economy. Their prices are directly related to their discovery, extraction and consumption and determine the cost of many goods and services. You can trade them to try and capitalise on this supply and demand dynamic.

Popular commodities

Crude Oil

Symbol: USOIL

Brent Oil

Symbol: UKOIL

Natural Gas

Symbol: USNGAS

Gold

Symbol: XAUUSD

Silver

Symbol: XAGUSD

How commodities trading works

Commodity trading allows you to speculate on the price movements of commodities without owning the physical commodities. If you think the price of a commodity is likely to rise, you can simply buy it. If you think the price of the commodity is likely to fall, you can sell it.

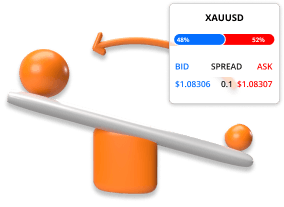

Bied- en laatprijzen

Each commodity is quoted with two prices, the 'Bid' price and the 'Ask' price. The bid price is the price at which you can sell the commodity. While the ask price is the price at which you can buy it. The ask price is always higher than the bid price and the difference between these prices is called the 'Spread'.

Go long or short

The basic idea is to buy (go long) when you think the commodity will appreciate in value and sell (go short) when you think it will depreciate in value. You can trade commodities long or short, meaning that you can trade rising as well as falling prices.

Commodities are traded in lots

When trading commodities, trades are placed in terms of lots. Where one lot is determined by the quantity of the commodity being traded. For example, one standard lot for gold is 100 ounces, one mini lot is 10 ounces and one micro lot is one ounce. Check our contracts specifications page to learn more about commodity lot sizes.

Commodity trading involves leverage and margin

Commodity trading involves using leverage, which allows you to buy and sell commodities worth more than the amount you have in your trading account. For example, trading with 10:1 leverage would allow you to buy 100 barrels of crude oil at only 10% of the current market value. Leverage can magnify potential profits but it also increases risk and speeds up losses.

Commodities trading example

You decide to buy 0.1 lots of Crude Oil at $70 using 10:1 leverage.

0.1 lots = 100 barrels of Crude Oil

100 barrels x $70 = $7,000

USD 7,000 / 10 = $700

Scenario 1

Crude Oil moves up from $70 to $80 and you decide to sell.

De winst of het verlies op de transactie zou als volgt worden berekend.

W/V = (Huidige prijs - Initiële prijs) × Aantal

P/L = ($80 - $70) × 100

P/L = $10 × 100

P/L = $1,000

Scenario 2

Crude Oil moves down from $70 to $60 and you decide to sell.

De winst of het verlies op de transactie zou als volgt worden berekend.

W/V = (Huidige prijs - Initiële prijs) × Aantal

P/L = ($60 - $70) × 100

P/L = -$10 × 100

P/L= - $1,000

Voordelig handelen met een eersteklas service

Daarom kiezen mensen zoals jij voor TIOmarkets

Spreads vanaf 0,0 pips

Handel met ruwe variabele spreads direct van onze liquiditeitsverschaffers

Nul commissie

Handel vanaf $0 per lot op onze VIP Black- of standaardrekening

Lage startbedrag

Open je account vanaf slechts €100 om te beginnen met handelen

24/7 klantenservice

We zijn er om te helpen, met een gemiddelde responstijd van 3 seconden op de live chat

Snelle orderuitvoering

Trades worden in milliseconden uitgevoerd, meestal met een lage slippage

Betrouwbare platforms

Handel op wereldwijde financiële markten via de MT4 desktop- of mobiele handelsplatformen

35.45% of retail CFD accounts lose money

Handel op het MT4 handelsplatform

MT4 is ontworpen en ontwikkeld voor forex- en futureshandel. Om handelaren in staat te stellen financiële markten te analyseren en te verhandelen, handelsstrategieën te testen, handelsrobots te ontwikkelen en andere handelaren te kopiëren.

Beschikbaar voor:

Snel en eenvoudig aan de slag

Het duurt maar een paar minuten, zo werkt het

STAP 1

Aanmelden

Vul een eenvoudig formulier in om uw profiel aan te maken en het verificatieproces te voltooien. Zodra u bent geverifieerd en goedgekeurd, kunt u uw handelsaccount aanmaken.

STAP 2

Storten

Stort direct met uw bankpas of creditcard. Download het handelsplatform naar uw computer of smartphone.

STAP 3

Handel

Kies een instrument en richting, beslis hoeveel u wilt investeren en plaats uw transactie.

35.45% of retail CFD accounts lose money

Learn more about our trading conditions

TIO Markets CY Limited, a company authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC), has decided to voluntarily renounce its authorisation and has submitted the relevant request to CySEC.

As a result, the company is not accepting new clients.

In case of any questions, please contact [email protected]

In case of any complaints, please contact [email protected]