Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 35.45% of retail investor accounts lose money when trading CFDs. You should

Trade CFDs on commodities

Trade gold, silver, platinum, palladium, crude oil and natural gas

35.45% of retail CFD accounts lose money

Trade global commodities

Symbol

Bid

Ask

Spread

*The prices on this page are indicative. Prices for instruments with lower liquidity such as but not limited to exotic currency pairs, stocks and indices are not refreshed as often as commonly traded instruments. Please check inside your MT4 platform for latest live prices

What are Commodities?

Commodities like gold, silver, platinum, oil and natural gas are raw materials that play a fundamental role in the global economy. Their prices are directly related to their discovery, extraction and consumption and determine the cost of many goods and services. You can trade them to try and capitalise on this supply and demand dynamic.

Popular commodities

Crude Oil

Symbol: USOIL

Brent Oil

Symbol: UKOIL

Natural Gas

Symbol: USNGAS

Gold

Symbol: XAUUSD

Silver

Symbol: XAGUSD

How commodities trading works

Commodity trading allows you to speculate on the price movements of commodities without owning the physical commodities. If you think the price of a commodity is likely to rise, you can simply buy it. If you think the price of the commodity is likely to fall, you can sell it.

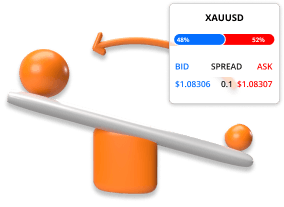

Bid and ask prices

Each commodity is quoted with two prices, the 'Bid' price and the 'Ask' price. The bid price is the price at which you can sell the commodity. While the ask price is the price at which you can buy it. The ask price is always higher than the bid price and the difference between these prices is called the 'Spread'.

Go long or short

The basic idea is to buy (go long) when you think the commodity will appreciate in value and sell (go short) when you think it will depreciate in value. You can trade commodities long or short, meaning that you can trade rising as well as falling prices.

Commodities are traded in lots

When trading commodities, trades are placed in terms of lots. Where one lot is determined by the quantity of the commodity being traded. For example, one standard lot for gold is 100 ounces, one mini lot is 10 ounces and one micro lot is one ounce. Check our contracts specifications page to learn more about commodity lot sizes.

Commodity trading involves leverage and margin

Commodity trading involves using leverage, which allows you to buy and sell commodities worth more than the amount you have in your trading account. For example, trading with 10:1 leverage would allow you to buy 100 barrels of crude oil at only 10% of the current market value. Leverage can magnify potential profits but it also increases risk and speeds up losses.

Commodities trading example

You decide to buy 0.1 lots of Crude Oil at $70 using 10:1 leverage.

0.1 lots = 100 barrels of Crude Oil

100 barrels x $70 = $7,000

USD 7,000 / 10 = $700

Scenario 1

Crude Oil moves up from $70 to $80 and you decide to sell.

This is how the profit or loss on the trade would be calculated.

P/L = (Current price - Initial price) x Quantity

P/L = ($80 - $70) × 100

P/L = $10 × 100

P/L = $1,000

Scenario 2

Crude Oil moves down from $70 to $60 and you decide to sell.

This is how the profit or loss on the trade would be calculated.

P/L = (Current price - Initial price) x Quantity

P/L = ($60 - $70) × 100

P/L = -$10 × 100

P/L= - $1,000

Great value trading with a premium service

This is why people like you choose TIOmarkets

Spreads from 0.0 pips

Trade with raw variable spreads directly from our liquidity providers

Zero commission

Trade from $0 per lot on our VIP Black or Standard account

Low starting amount

Open your account from just €100 to start trading

24/7 customer support

We are here to help, with 3 seconds average response time on live chat

Fast order execution

Trades are executed in milliseconds, with low slippage, most of the time

Reliable platforms

Trade global financial markets on the MT4 desktop or mobile trading platforms

35.45% of retail CFD accounts lose money

Trade on the MT4 trading platform

MT4 was designed and developed for forex and futures trading. To enable traders to analyze and trade financial markets, back test trading strategies, develop trading robots and copy other traders.

Available for:

Getting started is quick and simple

It only takes a few minutes, this is how it works

STEP 1

Register

Fill out a simple form to create your profile and complete the verification process. Once you are verified and approved, you will be able to create your trading account.

STEP 2

Fund

Deposit instantly with your debit or credit card. Download the trading platform to your computer or smartphone.

STEP 3

Trade

Pick an instrument and direction, decide how much to invest and place your trade.

35.45% of retail CFD accounts lose money

Learn more about our trading conditions

TIO Markets CY Limited, a company authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC), has decided to voluntarily renounce its authorisation and has submitted the relevant request to CySEC.

As a result, the company is not accepting new clients.

In case of any questions, please contact [email protected]

In case of any complaints, please contact [email protected]