Varování před rizikem: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 35.45% of retail investor accounts lose money when trading CFDs. You should

Trade CFDs on commodities

Trade gold, silver, platinum, palladium, crude oil and natural gas

35.45% of retail CFD accounts lose money

Trade global commodities

Symbolu

Poptávka

Nabídka

Spread

*The prices on this page are indicative. Prices for instruments with lower liquidity such as but not limited to exotic currency pairs, stocks and indices are not refreshed as often as commonly traded instruments. Please check inside your MT4 platform for latest live prices

What are Commodities?

Commodities like gold, silver, platinum, oil and natural gas are raw materials that play a fundamental role in the global economy. Their prices are directly related to their discovery, extraction and consumption and determine the cost of many goods and services. You can trade them to try and capitalise on this supply and demand dynamic.

Popular commodities

Crude Oil

Symbol: USOIL

Brent Oil

Symbol: UKOIL

Natural Gas

Symbol: USNGAS

Gold

Symbol: XAUUSD

Silver

Symbol: XAGUSD

How commodities trading works

Commodity trading allows you to speculate on the price movements of commodities without owning the physical commodities. If you think the price of a commodity is likely to rise, you can simply buy it. If you think the price of the commodity is likely to fall, you can sell it.

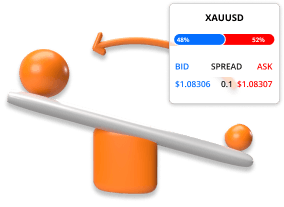

Kupní a prodejní cena (Bid a Ask)

Each commodity is quoted with two prices, the 'Bid' price and the 'Ask' price. The bid price is the price at which you can sell the commodity. While the ask price is the price at which you can buy it. The ask price is always higher than the bid price and the difference between these prices is called the 'Spread'.

Otevřete dlouhou nebo krátkou pozici

The basic idea is to buy (go long) when you think the commodity will appreciate in value and sell (go short) when you think it will depreciate in value. You can trade commodities long or short, meaning that you can trade rising as well as falling prices.

Commodities are traded in lots

When trading commodities, trades are placed in terms of lots. Where one lot is determined by the quantity of the commodity being traded. For example, one standard lot for gold is 100 ounces, one mini lot is 10 ounces and one micro lot is one ounce. Check our contracts specifications page to learn more about commodity lot sizes.

Commodity trading involves leverage and margin

Commodity trading involves using leverage, which allows you to buy and sell commodities worth more than the amount you have in your trading account. For example, trading with 10:1 leverage would allow you to buy 100 barrels of crude oil at only 10% of the current market value. Leverage can magnify potential profits but it also increases risk and speeds up losses.

Commodities trading example

You decide to buy 0.1 lots of Crude Oil at $70 using 10:1 leverage.

0.1 lots = 100 barrels of Crude Oil

100 barrels x $70 = $7,000

USD 7,000 / 10 = $700

Scenario 1

Crude Oil moves up from $70 to $80 and you decide to sell.

Takto se vypočítá zisk nebo ztráta z obchodu:

P/L = (Aktuální cena – Počáteční cena) × Množství

P/L = ($80 - $70) × 100

P/L = $10 × 100

P/L = $1,000

Scenario 2

Crude Oil moves down from $70 to $60 and you decide to sell.

Takto se vypočítá zisk nebo ztráta z obchodu:

P/L = (Aktuální cena – Počáteční cena) × Množství

P/L = ($60 - $70) × 100

P/L = -$10 × 100

P/L= - $1,000

Skvělý obchodní zážitek za výhodnou cenu s prémiovou službou

Proto si lidé jako vy vybírají TIOmarkets

Spready od 0,0 pipů

Obchodujte s reálnými variabilními spready přímo od našich poskytovatelů likvidity

Žádná provize

Obchodujte od 0 $ za lot na našem účtu VIP Black nebo Standard.

Nízká počáteční částka

Otevřete si účet již od €100 a začněte obchodovat

24/7 zákaznická podpora

Jsme tu, abychom pomohli, s průměrnou dobou odpovědi na live chatu 3 sekundy

Rychlé provedení objednávek

Obchody jsou prováděny v milisekundách, většinu času s nízkým skluzem

Spolehlivé platformy

Obchodujte na globálních finančních trzích na desktopové nebo mobilní platformě MT4

35.45% of retail CFD accounts lose money

Obchodujte na obchodní platformě MT4.

MT4 byla navržena a vyvinuta pro obchodování na forexu a futures. Umožňuje obchodníkům analyzovat a obchodovat finanční trhy, testovat obchodní strategie zpětně, vyvíjet obchodní roboty a kopírovat ostatní obchodníky.

Dostupné pro:

Začít je rychlé a jednoduché

Zabere to jen pár minut, takto to funguje

KROK 1

Registrovat

Vyplňte jednoduchý formulář pro vytvoření svého profilu a dokončete proces ověření. Jakmile budete ověřeni a schváleni, budete moci vytvořit svůj obchodní účet.

KROK 2

Vložit prostředky

Okamžitě vložte peníze pomocí debetní nebo kreditní karty. Stáhněte si obchodní platformu do počítače nebo chytrého telefonu.

KROK 3

Obchodovat

Vyberte si finanční nástroj a směr, rozhodněte se, kolik chcete investovat, a zadejte svůj obchod.

35.45% of retail CFD accounts lose money

Learn more about our trading conditions

TIO Markets CY Limited, a company authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC), has decided to voluntarily renounce its authorisation and has submitted the relevant request to CySEC.

As a result, the company is not accepting new clients.

Existing clients with remaining balances are requested to log in to their accounts and withdraw their funds.

In case of any questions, please contact [email protected]

In case of any complaints, please contact [email protected]